For a downloadable version, click here: Portfolio Management Service A presentation introducing the concepts behind the service may be found here: Quantitive Portfolio Management

Introduction

There are many circumstances when managers are responsible for allocating investment budgets when the outcomes from those investments are far from certain. There are two sorts of uncertainties:

- Tangible benefits – The benefits are easily expressed in terms of money, but the future costs and benefits cannot be known for certain.

- Intangible benefits – Often the benefits are not easily expressed in terms of money, but more in terms of organization mission or strategic alignment. Even when the benefits can be measured, such as ‘lives saved’, the future benefits also cannot be known for certain.

Either or both sorts of uncertainties my apply.

Examples of organizations facing this budgeting challenge include research and development organizations (including software), IT organizations rolling out new capabilities, and mission-based organizations such as government agencies, NGO’s, and not-for profits.

Anyone responsible for setting and allocating the investment budget in the face of uncertainty is faced with many hard questions:

- Are you managing your projects to get the most value from your organization?

- Do you know how much you should invest in a given effort?

- Do you know how much financial risk you are assuming when you ship the offering – are you betting the organization every time you ship?

- Are you addressing uncertainty in your business cases to balance your portfolio between innovative efforts and low hanging fruit?

- Do you know when it makes economic sense to ship the offering (when the expected benefits outweigh the expected expenses?

Conventional, qualitative portfolio management tools rank intangibles such as ‘strategic alignment’ and ‘risk score’ to set priorities. These have their place, but they fall short of answering the above questions. Adopting these methods alone may result in:

- The staff with the strongest opinions will prevail in getting their pet projects funded.

- Difficult conversations with stakeholders such as the CFO who wants to know if the money is being spent wisely.

Based on the techniques of Douglas Hubbard (Douglas Hubbard, How to Measure Anything: Finding the Value of Intangibles in Business (3rd ed.), Wiley, 2014), I take the perspective that budgeting an uncertain effort should be approached as any other investment. One needs to know the value of the asset and certainty of the payoff. Also the approach has to be consumable and empower all of the stakeholders and subject matter experts (project management, support, product management, business analysis, security engineering, etc.) to work with the models and make good decisions.

Taking a more quantitative, science-based approach can take much of the emotion out of the decision process. All the subject matter experts have the same view of models and assumptions going into the model. The approach provides the opportunity for all the internal experts to provide their input including their uncertainties, captured as best case, worse case and most likely values. The tool provides an objective roll-up for joint decision-making.

The approach starts with business case elements, the costs and benefits that accrue over time.

The costs include

- Development and distribution costs

- Technical debt – Estimated costs of addressing known shortfalls in the offering after delivery

- Technical liability – Estimated costs of addressing possible bad business outcomes resulting from the offering.

The benefits vary with the mission of the enterprise. For example, the benefits from a new software application could be revenue from direct sales, revenue from indirect effects such as more customer visits to a website or improved sentiment, cost avoidance due to automation. Benefits for not-for-profits could be mission-based measures such as ‘acres preserved’, ‘people vaccinated’, people vaccinated, or something more intangible such as ‘quality of life improved’.

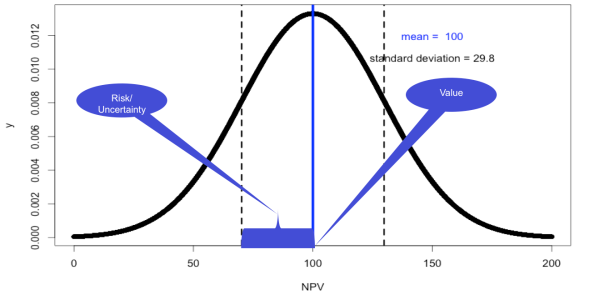

When the future costs and benefits of an investment are uncertain, the net present value (NPV) and the return on investment (ROI) are also uncertain and so are best described with a probability distribution (Figure 1.)

I will help you identify the costs and benefits (tangible and intangible), work with stakeholders and subject matter experts to identify or build models for each, and then elicit the range of inputs to build and deliver a simulation tool for generating the NPV distributions. These deliverables take into account schedule uncertainties.

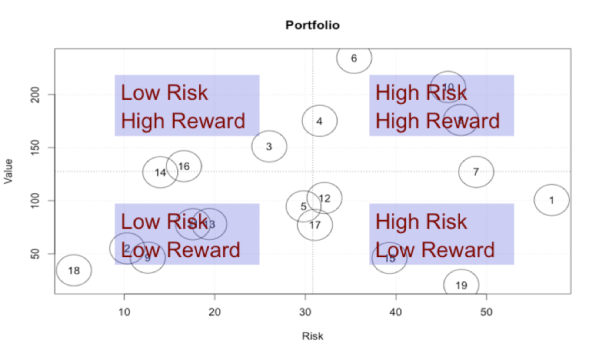

With these distributions, one can build a quantified view of the investment portfolio. Figure 2 provides a view with each bubble a different investment alternative.

The service

Every organization has different modeling needs. The costs and benefits differ. Also, some organizations need elaborate, highly faithful models, while others need simple “in the ballpark” models to drive improved collaboration and decision-making.

In particular the deliverables include a tailored, quantified net present value for each product under consideration. The model will be delivered in excel with an embedded Monte Carlo simulation tool. If there is more than one product, a tool providing the portfolio value/risk view will be included.

In particular, the service consists of the following modules:

- Quantitative portfolio planning workshop ($20,000 + expenses)

The outcome of this workshop is a tailored quantitative investment model-building plan. The three-day workshop consists of

|

The deliverables from the planning workshop include

- A detailed solution design document reporting on the outcome of the workshop

- Recommendations for the prioritized investment model rollout

- Recommendations for the cross-organization team members to develop and maintain the model.

- A proposal for the model building workshop including pricing and expected level of effort.

- If desired, a PowerPoint presentation to management of the workshop results and recommendations

- NPV model building, working with stakeholders and subject matter experts identified in the workshop.

The deliverables include:

- A pilot-ready working quantitative investment model delivered as an Agena Risk model, and

- A pilot-ready R-based application for generating the portfolio view.

- A user guide describing the appropriate usage models

- Proposal for the rollout program

- Organization rollout program.

In this module, we deliver the assets required to enable you to continue to use, roll-out and adapt the model going forward. The deliverables include

- Delivery of a training program of how to build and use the models tailored to your organization.

- Either a teach-the-teachers program or model-specific training for different parts of your organization.

- Training of usage models such as portfolio management, shipping decision support, or lean startup pivot.

- How to install and configure the tools.